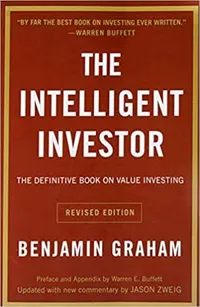

Intelligent Investor

The Definitive Book on Value Investing

Paperback

£13.99

Shipping and delivery

Standard delivery: 3–5 days after dispatch

United Kingdom: GBP 2.99

“By far the best book on investing ever written.”

— Warren Buffett

“The Intelligent Investor” is the definitive guide to value investing, written by the legendary Benjamin Graham. This book provides readers with the knowledge and tools to make informed investment decisions, avoid common pitfalls, and build long-term wealth in the stock market.

Readers will learn:

• How to analyze stocks using Graham’s time-tested methods

• The difference between investing and speculation

• Strategies for both defensive and enterprising investors

• The importance of emotional discipline in investing

• How to apply the margin of safety concept to minimize risk

The book includes:

• Updated commentary by financial journalist Jason Zweig

• Real-world examples and case studies

• Practical advice for implementing Graham’s principles in modern markets

“The Intelligent Investor” remains an essential read for those who want to develop a disciplined approach to investing. Its enduring popularity is a testament to the timeless nature of Graham’s wisdom, which continues to guide investors through bull and bear markets alike.

Year Published

Publisher

Pages

Weight

Language

ISBN 10

ISBN 13

Meet the author

Benjamin Graham (1894-1976) was a British-born American economist, investor, and professor widely regarded as the “father of value investing.” After graduating from Columbia University at age 20, Graham began his career on Wall Street, eventually founding the successful Graham-Newman Corp. mutual fund. He authored two seminal texts in finance: “Security Analysis” (1934) with David Dodd and “The Intelligent Investor” (1949), which Warren Buffett called “the best book about investing ever written.” Graham taught at Columbia Business School for nearly three decades, where he mentored notable investors like Buffett. His investment philosophy emphasized thorough fundamental analysis, emotional discipline, and the concept of “margin of safety.” Graham’s methods revolutionized stock analysis, transforming investing from speculation to a more systematic, logical approach. Beyond finance, he held several U.S. patents, wrote a Broadway play, and enjoyed translating classical works in his spare time.

What you'll learn

- Learn to invest with a margin of safety, reducing potential investment losses and protecting your principal capital.

- Develop a disciplined approach to investing by understanding the difference between investing and speculating.

- Acquire techniques for identifying undervalued stocks and creating a balanced investment portfolio.

- Master the psychological aspects of investing by learning to remain calm during market volatility.

Intelligent Investor" is the perfect book for:

• Novice investors seeking a solid foundation in value investing

• Experienced investors looking to refine their strategies

• Anyone interested in long-term wealth building through the stock market

• Business and finance students studying investment principles

Book testimonials

“If you read just one book on investing during your lifetime, make it this one”

— Fortune

“The wider Mr. Graham’s gospel spreads, the more fairly the market will deal with its public.”

— Barron’s

How to Pick the Right Book

Choosing the right book shouldn’t feel overwhelming. This quick 3-step process helps you find the one that fits your journey.

Define your goal

Are you building a business, improving your health, or mastering a skill? Pick books that match your personal mission.

Learn Your Way

Prefer visuals? Go for infographic-rich guides. Like action? Pick books with exercises and checklists.

Trust the Source

Look for authors with real experience — CEOs, athletes, researchers — and books grounded in results, not fluff.